The Mortgage Corner

The housing market is also in a “medically induced coma” (economist Paul Krugman’s term), as is most of our economy. However, I believe housing will recover sooner than other parts of the economy, because Americans still need more dwellings, to put it bluntly.

But how and what will be provided—whether to the already affluent, or entry-level first timers—will be the overriding issue.

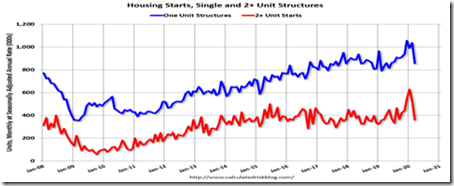

On the construction front, the Commerce Department said March housing starts plunged 22.3 percent to a seasonally adjusted annual rate of 1.216 million units last month. That was the largest monthly decline in starts since March 1984, according to Reuters.

But housing starts are still up 1.4 percent annually from the March 2019 rate. This is a sign that builders aren’t that pessimistic about future prospects, even during a pandemic when prospective buyers can’t visit models, and documents can’t be handled face-to-face.

And though total existing-home sales, https://www.nar.realtor/existing-home-sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 8.5 percent from February to a seasonally-adjusted annual rate of 5.27 million in March, overall sales increased year-over-year for the ninth straight month, up 0.8 percent from a year ago (5.23 million in March 2019).

Not many of the presidential candidates have even broached the issue of affordability. It’s mainly been governors such California’s Gavin Newsome, or mayors like Los Angeles’ Eric Garcetti, because California has the most acute housing problem, being the most populous state and 5th or 6th largest economy in the world continually producing more jobs then housing.

It is so bad that Governor Newsom has acquisitions more than 15,000 hotel units to house the homeless that may have been exposed or become infected with COVID-19.

Senator Elizabeth Warren has been the most outspoken of the candidates about reforming the housing market.

Her American Housing and Economic Mobility Act introduced first in 2018, “…makes historic federal investments to increase housing supply,” she said recently. “It invests $500 billion over the next ten years to build, preserve, and rehab units that will be affordable to lower-income families. A big chunk of that investment leverages private dollars so that taxpayers get the most bang for their buck.

“By building millions of new units, my plan will reduce the cost of rent for everyone. An independent analysis from Mark Zandi, the Chief Economist at Moody’s Analytics, found that my plan would reduce rental costs by 10 percent over the next ten years. And because my plan invests in housing construction and rehabilitation, the Moody’s analysis also finds that it would create 1.5 million new jobs.”

Governments can also increase the availability of government-insured (GSE) mortgages via Fannie Mae, Freddie Mae, and FHA. Lending standards have not been relaxed since the end of the Great Recession, with average credit scores for those approved at the very high bar of +720 FICO scores, when a 680 credit score was more than adequate to qualify for a mortgage before the housing bubble.

I believe the historically-low interest rates will hold and the Fed will continue with the QE purchase of mortgage-backed securities; a market that was on the verge of collapse until the Fed stepped in with its blank-check buying program.

The National Association of Home Builders (NAHB) announced that weekly data reveal significant declines in new home buyer traffic, and the NAHB/Wells Fargo Housing Market Index (HMI) declined 42 points in April, falling from a high level of 72 in March to 30.

“Unfortunately, we knew home sales would wane in March due to the coronavirus outbreak,” said Lawrence Yun, NAR’s chief economist. “More temporary interruptions to home sales should be expected in the next couple of months, though home prices will still likely rise.”

First-time buyers were responsible for 34 percent of sales in March, up from 33 percent in March 2019. NAR’s 2019 Profile of Home Buyers and Sellers – released in late 2019 – revealed that the annual share of first-time buyers was 33 percent. That is far below the more normal 40 percent historical share of entry-level, affording housing during boom times, said the NAR.

So we will never be able to cure the lack of affordable housing without some kind of government support, such as programs that Senator Warren has envisioned in her Senate bill that sits in committee, held up by a Republican majority that believes government is the problem.

Harlan Green © 2020

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen