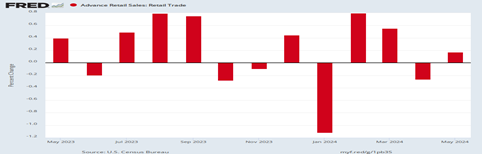

American consumers are tiring after two years of no relief from higher prices and interest rates. They are now looking for bargains everywhere in the latest retail sales report from the Census Bureau.

It’s the second month of the second quarter that sales have disappointed, and consumer spending is a large part of Q2 growth.

“Advance estimates of U.S. retail and food services sales for May 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $703.1 billion, up 0.1 percent (±0.4 percent) * from the previous month, and up 2.3 percent (±0.5 percent) above May 2023,” said the U.S. Census Bureau.

This was in part because gas prices had declined -2.2 percent. Revised April retail sales declined -0.2 percent. The retail report is going to boost both stock and bond prices, which means interest rates should continue to decline. It also means consumers are spending less on travel and entertainment, parts of the service sector that have been powering most of the economic growth to date.

The biggest negative in the May retail report was a 0.4% decline in spending at restaurants. Restaurant spending has fallen in four of the past six months for the first time since the pandemic. Sales also fell at home centers, grocery stores and stores that sell furniture — a residue of rising housing prices and high mortgage rates.

Yet sales rose at internet retailers, clothing outlets and big-box electronics stores, suggesting Americans still have some money left over to pay for so-called discretionary goods, or things people want, rather than need, to buy.

But manufacturing is taking up some of the slack as overall industrial production rose 0.9% in May, the Federal Reserve also reported on Tuesday. That is the biggest gain since last July. The manufacturing component rose 0.9% in May after a 0.4% fall in the prior month.

Part of the boost was from motor vehicles and parts output that jumped 0.6% after a 1.9% drop in the prior month. Excluding cars, total industrial output increased 0.7%, so auto sales are helping to boost growth.

What does it mean for Q2 economic growth? Estimates are still all over the map. The latest data was good enough to keep the Atlanta Fed’s GDPNow estimate of Q2 growth at 3.1 percent, up from 2.6 percent on June 6. It remained above 3 percent because a drop in PCE (consumer spending) was outweighed by a rise in second-quarter real gross private domestic investment growth (i.e., replacing inventory and buying new equipment) and second-quarter real government spending growth (on such as combatting climate change and modernizing the American economy).

Fed officials now must decide if they want to slow economic growth even more, and maybe risk a downturn come the fall. Do they want to spoil the holidays? I wonder if they will dare in this election year.

Harlan Green © 2024

Harlan Green on Twitter: https://twitter.com/HarlanGreen

Pingback: Retail Sales Falter–What May Follow? – the Java Exchange