Declining inflation has stalled in the first quarter, which is hurting prospects for any Fed rate cuts, and causing consumers to buy less. The inflation rate is currently stuck in the 3 percent range, though much lower for goods earlier in the supply chain, so large retailers like Walmart and Target are having to cut prices.

Monthly retail sales didn’t increase at all in May, after two consecutive months of 0.8 percent growth and almost 3 percent annual growth.

Walmart said on May 16 that it has rolled back prices on nearly 7,000 items in its stores, reports CNN, noting deflationary trends in general merchandise.

“Our combination of everyday low prices plus a large number of rollbacks is resonating” with consumers, Walmart CEO Doug McMillon said on a call with analysts.

CNN also reported that Target slashed prices on more than 1,500 items, ranging from laundry detergent to cat food to sunscreen, with thousands more price cuts expected over the summer.

It’s a sign that’s made Federal Reserve Governors more hopeful inflation will continue to decline, and prices even begin to fall, rather than continue to rise more slowly.

Federal Reserve officials at their last policy meeting indicated they still had faith price pressures would ease, if only slowly, according to the minutes of the central bank’s April 30-May 1 session.

“Participants … noted that they continued to expect that inflation would return to 2% over the medium term,” the minutes said, but “the disinflation would likely take longer than previously thought.”

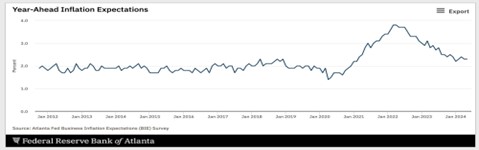

Inflation trends seem to be in the eye of the beholder. Businesses are now seeing much lower inflation, according to recent surveys. Year-ahead inflation expectations had fallen to 2.3 percent in May 2024 from as high as 3.8 percent in March 2022 for businesses, according to the Atlanta Federal Reserve.

Whereas the Federal Reserve Bank of New York’s Center for Microeconomic Data today released the April 2024 Survey of Consumer Expectations, which went in the opposite direction.

It shows that inflation expectations increased at the short-term and longer-term horizons, while decreasing at the medium-term horizon: to 3.3% from 3.0% at the one-year horizon (remaining below its 12-month trailing average of 3.5%).

The main culprit seems to be housing prices. “Median home price growth expectations increased to 3.3% after remaining unchanged at 3.0% for seven consecutive months. This is the highest reading of the series since July 2022,” said the NY Fed.

Year-ahead consumer commodity price expectations also rose across the board in April for gas, food, medical care, and college education.

Why aren’t consumers seeing the lower inflation expectations of businesses? Target and Walmart are telling us why. Simply put, retail prices are much higher than the raw cost of goods and services charged to businesses for several reasons. There’s the transportation and distribution costs, for starters, and profit margin that retailers must retain to stay in business.

The truth is that consumers are seeing higher costs than businesses and are beginning to rebel by choosing cheaper products. It also refutes an economic maxim about consumer behavior that higher inflation expectations will cause consumers to spend more, not less.

There is some good news for consumers. New-home prices are falling as the supply of new homes has increased.

Sales of newly built, single-family homes in April fell 4.7% to a 634,000 seasonally adjusted annual rate from a downwardly revised reading in March, according to newly released data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The pace of new home sales in April is down 7.7% from a year earlier.

The median new home sale price in April was $433,500, down 1.4% from March, and up 3.9% compared to a year ago. This is because of the increased supply. There’s a 9.1-month supply of new homes for sale.

Dear US Fed Governors, please pay attention to this. Shoppers can act rationally when their pocketbook size is at risk!

Harlan Green © 2024

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

Pingback: Whose Inflation Is Too High? – the Java Exchange

Pingback: Fed’s Preferred Inflation Indicator Softens | Populareconomicsblog